Casino bid clears suitability review

*

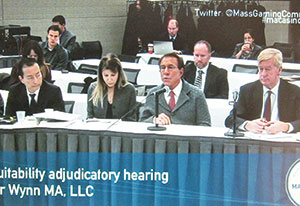

Casino owner Steve Wynn (2nd from right), who plans to build a resort casino on the Mystic River in Everett, appeared before the Massachusetts Gaming Commission Monday in a public hearing that was streamed live on the internet, accompanied by (left to right) Wynn Resorts executives James Stern and Kim Sinatra, and former Gov. William Weld, who was acting as Wynn’s attorney.

By Elizabeth Sheeran

Steve Wynn wants you to know he runs a clean business. The Las Vegas-based casino owner moved another step forward in his bid to build a casino in Everett, when he appeared before the Massachusetts Gaming Commission this week to make the case for his company’s suitability to hold a gaming license in this state.

“We in this industry have a presumption that we need to prove that we know the difference between right and wrong, and that we know how to conduct our business ethically,” said Wynn, founder and CEO of Wynn Resorts, who was represented by former Massachusetts Governor William Weld. “That presumption is due to the unsavory and colorful history of gaming as it was conducted in the past. I’m fully sensitive to that.”

Monday’s suitability hearing capped off a months-long background investigation into the “good character, honesty, integrity and financial responsibility” of Wynn Resorts and others involved in Wynn’s proposal to build a 350-room resort casino just across the river from Somerville’s Assembly Row.

The Gaming Commission’s Investigation and Enforcement Bureau (IEB) last week issued its 200-page report with the recommendation that Wynn be found “suitable” for licensing, subject to the condition that Wynn satisfy the commission that its business practices in Macau meet the state gaming law standard of “responsible business practices in any jurisdiction.”

During more than four hours of testimony and questions at Monday’s hearing, commissioners delved into the details of Wynn’s operations in the Chinese special administrative territory, where it is one of three big U.S. players in the world’s fastest-growing gaming market. Much focus was on so-called junket operators, who recruit high-end Chinese players to VIP rooms in Macau casinos, and who have at times been linked to organized crime.

Wynn executives described how junket operators are licensed and regulated by the Macau gaming authorities, and they detailed Wynn’s own procedures for vetting staff and preventing money laundering, which they said go above and beyond regulatory requirements for oversight.

“I don’t think that any executive in my business can stand up and say that with all that money moving around every second that everybody can keep track of it, not 100 percent perfectly,” said Wynn. “But the issue is do we allow illegal activity in our casinos? And the answer is no. No. No. Do we do everything that you can reasonably do to stop it? The answer is yes.”

Wynn said his past record from 47 years in the gaming industry should be a good indication of his commitment to compliance. “I want to sleep at night,” said Wynn, noting that his personal reputation is on the line for anything that happens in his casinos. “My name’s on the sign, so I’m going to take the rap.”

The commission did not immediately vote on the suitability finding recommendation at Monday’s hearing, but commissioners appeared to have had all their questions answered with respect to Macau.

Prior to the suitability hearing, Wynn had already taken steps to settle questions about who will benefit from its plans to buy the blighted riverfront property that was once a Monsanto Chemical plant. The IEB’s suitability report dedicated over 40 pages to its investigation into suspicions that “persons with documented criminal histories” had a hidden beneficial interest in FBT Everett Realty, the selling group.

Investigators concluded there was “a substantial basis” to believe sellers withheld material information from both Wynn and the IEB, and provided misleading and even falsified documents.

The report also laid out evidence, including transcripts of monitored prison phone conversations, that Revere businessman Charles Lightbody “possessed a significant criminal history and took affirmative steps to conceal his role and interest in the transaction,” since Lightbody’s involvement would hurt the buyer’s ability to get a casino license, which would in turn put a cap on the potential value of the property.

Investigators found no evidence Wynn could have or should have known about deliberately hidden interests in the land deal, and the Gaming Commission last week approved Wynn’s re-negotiated option to buy the land. The revised deal cuts the potential sale price from $75 million to $35 million, to reflect the land value without a casino license, and requires sellers to sign under oath that no one else will profit from the sale. Chairman Steven Crosby recused himself from the land deal vote due to a prior business relationship with one of the named sellers.

In other recent Gaming Commission decisions, Suffolk Downs got the green light to move forward with a Revere-only version of its own competitive casino bid, with Mohegan Sun as a partner. Now that commissioners have turned over all the stones in the Wynn deal, the contest for the single available resort casino license for Eastern Massachusetts looks to be nearing its final round, and both Revere and Everett are still in play.

Reader Comments